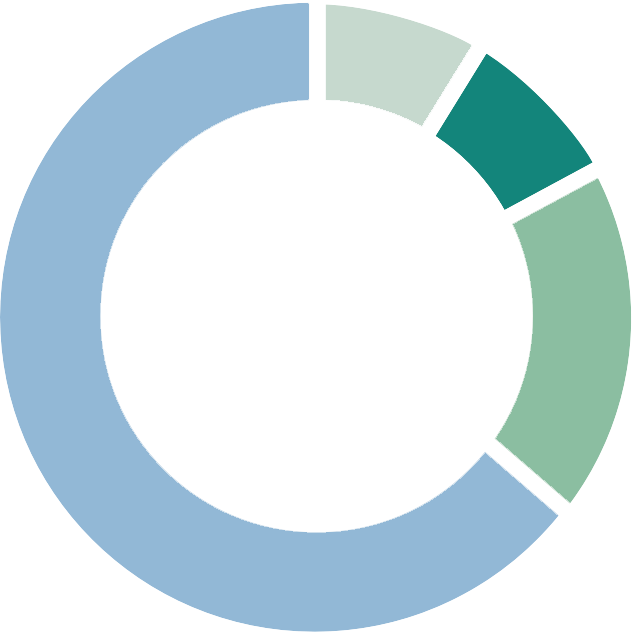

The third cost factor is incidental expenses. Here it is customary in the industry to use one percent of the property value. For a single-family house at a purchase price of one million francs, 10,000 francs would have to be budgeted each year. This includes various expenses: heating or energy, electricity, water, maintenance, repairs, building insurance, garden maintenance etc. In the case of an apartment (condominium ownership), the shared costs in the building are also included in incidental expenses (cost contributions for administration and maintenance, or payments into a renovation fund).

This one percent rule is used for the affordability calculation during credit checks and advisory sessions. Older properties may also incur higher maintenance and renovation costs.

Conclusion: the following motto clearly applies to the purchase of residential property: first budget and calculate, then buy. It is in the client’s own interest to carefully observe the rules of affordability. This prevents financial difficulties later on and guarantees that you can enjoy your own home without anything to worry about.