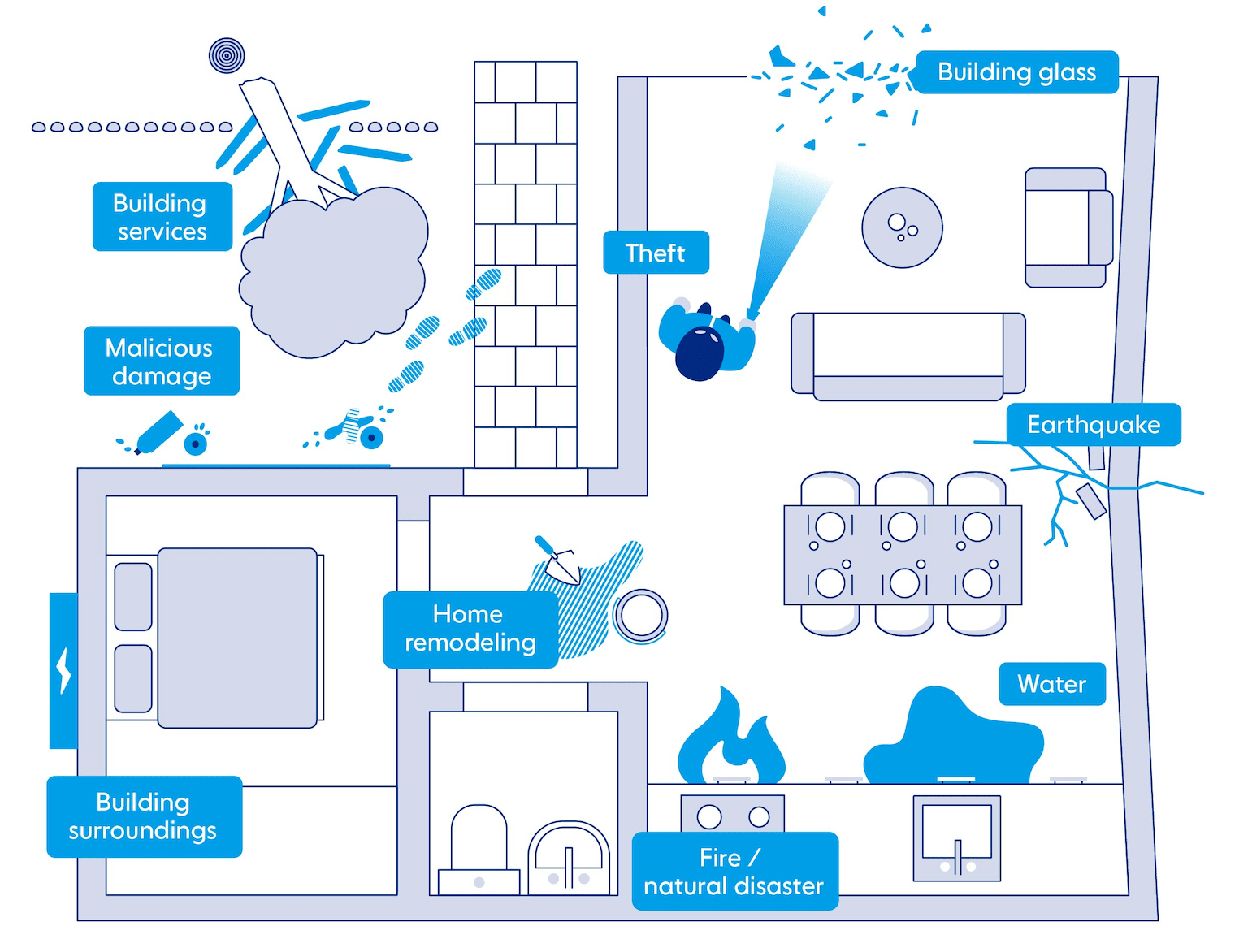

Building insurance: what’s covered?

Your dream of owning your own home has come true – now you need insurance. We explain the types of damage covered by building insurance, how to avoid reduced benefits, and what to do if you need to file a claim.

What’s insured?

In addition to building insurance against fire and natural disaster, which is almost always mandatory, there is a whole range of coverage available with which you can comprehensively protect yourself and your home. An overview:

Damage caused by fire or natural disaster: Fire, lightning, explosion, storm, hail, landslide, flooding, high water, etc.

In most cantons, this insurance is mandatory and must be taken out with the cantonal building insurer. This insurance is also mandatory in Uri, Schwyz, Obwalden and the Principality of Liechtenstein, but it can be taken out with a private company. In Geneva, Valais and Ticino, it is voluntary and can be taken out with a private insurer.

Example: Your building is severely damaged as a result of a fire or flood.

Destruction or damage to residential property caused by earthquakes or volcanic eruptions. Insurance with Baloise covers damage regardless of the strength of the earthquake.

Example: An earthquake causes considerable damage to your building, for example, it causes roof cornices or load-bearing components to collapse.

Damage caused by liquids flowing from pipes, by the ingress of rain, snow and melt water, by backwater and damage from groundwater and slope water. With Baloise, the costs of searching for a leak and uncovering it are always included in the insurance.

Example: Water enters the building through a defective water pipe and damages the parquet floor.

Damage to the building from a burglary or robbery. The costs for emergency glazing, emergency doors and emergency locks are also covered.

Example: Your house front door is severely damaged during a burglary.

Breakage to building glazing, facades and wall cladding made of glass, glass ceramic stove tops, covers made of natural or artificial stone, sanitary installations, the glass in photovoltaic systems, etc.

Example: A glass bottle falls into the sink and causes a continuous crack. Sink and faucets need to be replaced.

Sudden and accidental damage or destruction of building services equipment such as heating systems, plumbing systems, power supply, intercom systems, lightning protection systems, etc.

Example: A foreign object damages the heating system, which must be repaired or replaced.

Under the “extended coverage” module, damage caused by malicious damage, falling trees, building collapse or wild animals that have not been kept privately is insured.

Example: Your building is deliberately smeared with graffiti.

Damage in connection with renovation, maintenance, conversion, and extension work on the existing building, up to a maximum total construction cost of CHF 250,000. This also includes the theft of items newly installed on the building. In the event of damage caused by fire / natural disaster or water, the conversion work is already covered. All work must be performed by qualified construction experts.

Example: The floor is severely damaged during renovation work. The person who caused the damage is not known.

Damage to structural installations located on the property, such as swimming pools, driveways, fences, etc. The garden is also insured.

Example: Your garden and swimming pool are damaged during a storm.

The “building” security module ensures that benefits are not reduced in the event of damage caused by gross negligence.

Example: You leave the pan on the stove with the burner turned on and go shopping, leading to a kitchen fire.

Protection of the insured person’s interests in legal cases connected to their residential property, including the associated land, installations, and facilities.

Example: You are involved in a dispute with craftsmen because the work performed has significant defects, which they refuse to correct.

The costs of property damage or personal injury incurred in connection with the residential property, including the associated land and facilities, are covered.

Example: In winter, the mail carrier slips and injures themself on the icy path to your front door.

“Loss of earnings” coverage insures against loss of rental income if the premises are unusable, for example, after a fire.

The “Landlord” security module covers you if a tenant fails to pay rent owed despite reminders or debt collection measures. This module also covers property damage to the rented building caused by tenants, provided the tenant either has not taken out liability insurance or this insurance does not cover the costs or only covers them in part.

Example: Your tenant is gone, leaving behind a damaged apartment and rent in arrears.

What are my obligations?

As a policyholder, you also have obligations that you must fulfill. If you do not, your insurance benefits may be reduced, or your coverage may be interrupted or even terminated.

- Payment of insurance premiums

If you do not pay the insurance premium on time and do not settle it even after receiving a written reminder, your coverage will be stopped after 14 days. As soon as payment is made, coverage is reinstated. You will not be entitled to coverage in the event of a claim for the period not covered. - Duty to report

You must notify your insurance company of any alterations or additions, as well as changes in the use of rooms, as this will affect the amount insured and the covered losses. With the additional coverage of “precautionary insurance,” you can protect yourself against benefit reductions. - Duty of disclosure and burden of prooft

In the event of a loss, you must contact your insurance company immediately and truthfully report to them the circumstances of the loss, as well as prove the amount of the loss with receipts and supporting documents. - Mitigation of damages

You are obligated to ensure that the damage is limited during and after the loss event, for example, by turning off the mains after a burst pipe. However, you must not take any measures that obscure or make it impossible to determine the cause of the damage. In any case, you must first discuss specific repairs with your insurance company.

How do I proceed in the event of a claim?

If a loss event occurs, contact your insurance company by telephone as soon as possible. You can then discuss the next steps directly. Document the damage with the date, time, photos and how the damage unfolded. Depending on the case, you may have to fill out a written damage report in addition to the telephone report and submit documents for examination about the course of the damage and the amount of the damage. In case of larger damages or more complex situations, a damage inspector will be called in to make an on-site assessment. As mentioned, repairs must always be discussed with the insurance company.

How do I find the right level of insurance for me?

Building insurance includes everything you need to protect your home as a homeowner. Whether you’re happy with just the minimum basic coverage just or feel most comfortable with the all-inclusive package depends entirely on where you live, your sense of security and your risk tolerance. We recommend that you arrange a personal consultation with a subject matter expert.