Construction insurance: a must for every building project

Why take out construction insurance?

Construction insurance applies for a limited period of time, i.e. from the start of a construction project until the acceptance of the building. It covers damage to people and incidents that occurs in connection with the construction work. Construction insurance is not obligatory, but is highly recommended, given the high potential for damage.

“Architectural firms have an obligation to inform the building owner of the benefits of construction insurance. The building owner can then take out insurance themselves or entrust their architect with the task.”

Martin Messerli, qualified mechanical engineer, head of underwriting for major clients, technical insurance, Baloise Insurance

The main advantage of taking out construction insurance is for the building owner, because they bear the overall responsibility for the construction project. Building a house often involves more than a hundred different people – from the architect and building owner to the countless tradesmen who carry out the construction work. With so many different parties, not only can damage arise quickly, but in many cases it is difficult to clearly identify who caused it. The problem is then not only that financial consequences may occur, but also that the construction project may be delayed. That’s why construction insurance steps in immediately to cover insured damage and ensure that it is paid for and repaired, enabling the construction work to continue rapidly.

What are the most common types of damage?

We spoke to a Baloise Insurance claims inspector. Experience shows that water damage is the most common type of damage in relation to construction insurance. It is caused either by improper execution of work or by damage to pipes during construction work. Damages of this kind result in costs starting at CHF 10,000 to 20,000, that can soon reach CHF 100,000 or more for a larger construction project.

The second most common type of damage is to the excavation pit, for instance if the slopes collapse, also affecting the neighboring property. Unprofessional execution or faulty planning are the most common causes. In larger incidents, this type of damage can cost as much as several hundred thousand francs.

These two examples are not only among the most common, but also the most expensive types of damage.

“Especially during conversion projects, there are many hidden risks. The older a property, the fewer records are usually available. That’s why it’s vital to carry out thorough preliminary clarifications before conversion work, such as assessing the structural properties of the building or checking the locations of pipes.”

Andrea Battiston, qualified civil engineer, claims inspector, Baloise Insurance

What is insured?

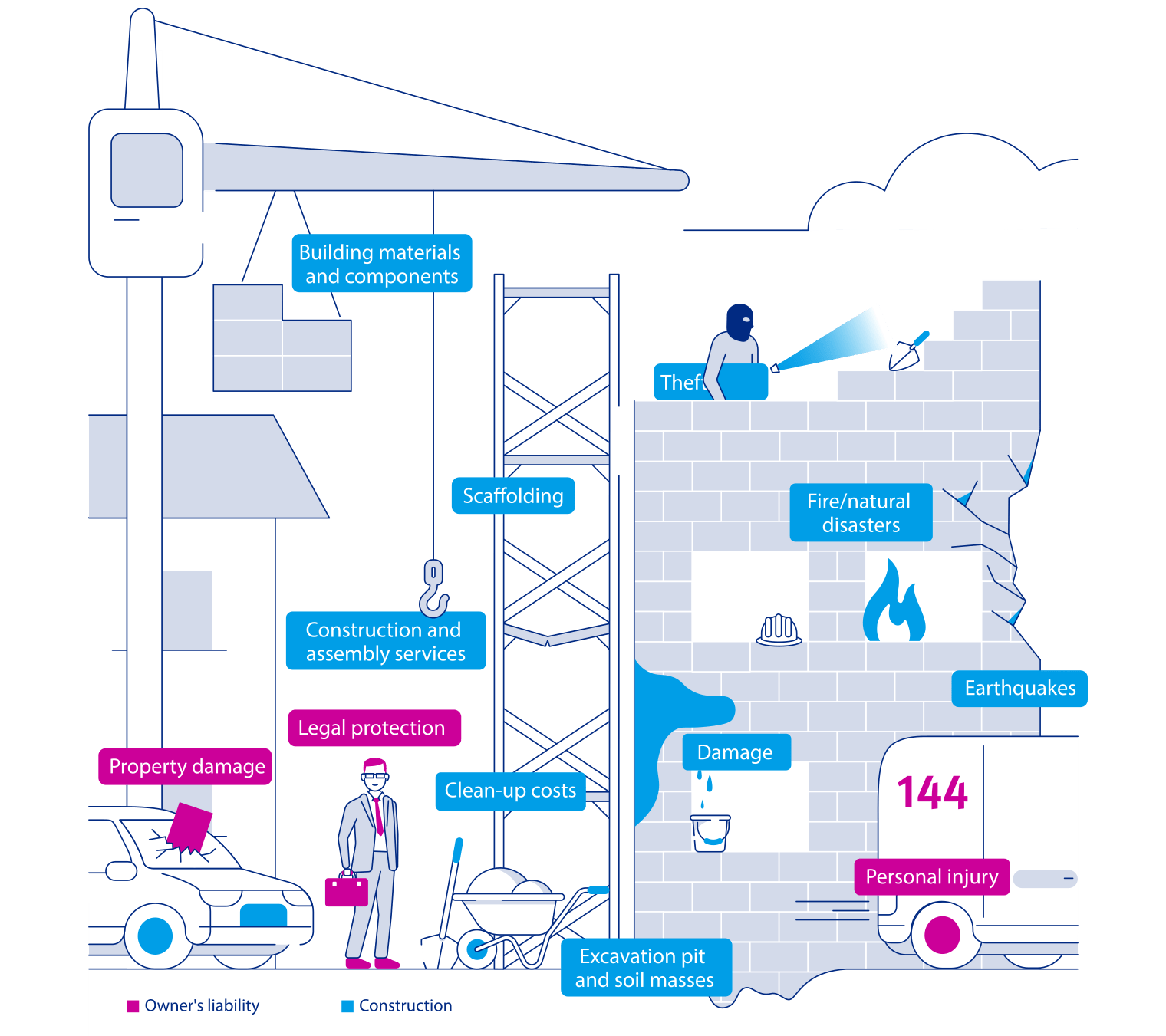

Let’s take a closer look at construction insurance and its components. The following chart shows the most important types of coverage that are integrated into contractor’s liability insurance and construction insurance (non-exhaustive list).

Contractor’s liability insurance

Contractor’s liability insurance covers damage to third parties or third-party property that occurs during construction work.

Example 1:

A construction project has reached the shell stage. Due to a violent gust of wind, part of the roof comes off and falls onto the road, damaging the neighbor’s car. In this case, the insurance company will cover the cost of repairing the car.

Example 2:

During the construction of an underground garage, the soil starts to move. As a result, cracks appear on the neighboring building. The insurance will cover the cost of restoring the third-party building and its surroundings to the condition they were in before being damaged. If the neighbors have to be accommodated elsewhere during the repair work, for example in a rented apartment, these costs will also be covered.

Example:

While inspecting a building site, the building owner leans on boards set up on the roof. The boards fall to the ground below and hit a passing pedestrian. Contractor’s liability insurance will cover the injured woman’s medical expenses and lost wages.

Example:

A crane overturns on a construction site, severely damaging the neighboring house and injuring two people. They file a criminal complaint against the building owner. In this case, attorneys’ fees, court costs, and plaintiffs’ litigation expenses will be paid if awarded by the court.

In addition to basic insurance, additional coverage can be included as needed, such as accident insurance for visitors. This applies to clients, visitors and anyone accompanying them.

Construction

Construction insurance is an all-risk insurance. This means that any unforeseen damage to or destruction of the building under construction that occurs during the term of the contract is insured. Conversion work up to a construction sum of CHF 250,000 can be included in building insurance. If you already have this coverage integrated into your building insurance, the only other type of insurance you need for your extension or conversion project is therefore contractor’s liability insurance.

When it comes to conversion work, if you want to increase the energy efficiency of the property you are renovating, you can use the Houzy energy calculator to measure your current energy efficiency and calculate the impact of certain types of renovation, how much they will cost and how much you can save in the longer term.

In many cantons, this coverage is already included in the mandatory cantonal construction period insurance (or, after completion of the construction work, in the building insurance). It can therefore only be taken out as part of a construction insurance policy in the cantons of Uri, Schwyz, Appenzell Innerrhoden, Obwalden, Geneva, Valais, Ticino and the Principality of Liechtenstein.

In all other cantons, however, construction insurance covers any construction services that are excluded from cantonal building insurance, e.g. the securing of excavation pits or work on the surrounding grounds.

Example:

A severe hailstorm causes damage to the building shell and to some material that had not yet been installed. This insurance coverage will pay for the restoration costs, clean-up and replacement of damaged materials.

Basic coverage also includes water damage caused by damage to pipes, backwater from the sewer system or groundwater.

Example:

A water pipe breaks during construction work. The leaking water damages the shell of the building. The insurance will cover the clean-up, material and labor costs.

This coverage insures the progress of the work, i.e. the practical tasks performed by construction workers, craftsmen and any other parties involved in the construction project.

All building materials and components used for the construction of the building are insured.

If components that have already been installed are stolen, they are insured under theft coverage. You can also insure the theft of items that are not connected to the structure. Simple theft is not insured.

This type of coverage concerns damage to the construction project caused by earthquakes or volcanic eruptions during the construction phase.

This additional coverage can be taken out to insure scaffolding, scaffolding materials and construction site equipment.

In the case of insured damage, clean-up costs of up to 10 percent of the construction sum are covered. If you want coverage beyond this amount, you can take out supplementary insurance. In addition to clean-up work, this coverage will also pay the costs of damage investigation as well as the demolition and reconstruction of non-damaged parts of the structure necessary to repair the damage.

Restoring the excavation pit is part of the basic coverage, but the replacement of soil masses is not included. Additional costs of this kind can be insured via this supplementary coverage. Natural hazards are also covered.

The appropriate level of insurance for your construction project depends on many factors: the construction costs, whether or not you as the building owner are involved in the construction yourself, what construction methods are used, how close the neighboring buildings are, what the building ground is like, whether rock has to be quarried for the construction project, etc. All these aspects are taken into account and evaluated during an insurance consultation.

Tips regarding the level of insurance to choose

The appropriate level of insurance for your construction project depends on many factors: the construction costs, whether or not you as the building owner are involved in the construction yourself, what construction methods are used, how close the neighboring buildings are, what the building ground is like, whether rock has to be quarried for the construction project, etc. All these aspects are taken into account and evaluated during an insurance consultation.

Do you have any other questions?

How much does construction insurance cost?

The premium largely depends on the construction costs. However, certain risk factors, and the level of insurance, are also taken into account. The easiest way to determine the premium is to arrange a personal consultation.

How are the construction costs calculated?

The construction costs can be calculated from items one to four on the construction cost plan (preparatory work, building, operating equipment, grounds) including VAT, fees and the building owner’s own contributions.

When should I take out construction insurance?

Ideally, you should look into taking out construction insurance a few weeks before work starts. This is because you can then include the cost of the premium directly in the construction cost plan.

What do I need to consider regarding my existing insurance policies when carrying out conversion work?

You should always report conversion work to your existing building insurance company. If the conversion results in an increase in the value of the building, the insured value must be adjusted accordingly to avoid underinsurance.