Household and building insurance: the differences

Damage to your home is unsightly and can be expensive to fix. The only way to minimize the financial cost is to have the right insurance. Building and home contents insurance go hand in hand, but how exactly do they differ and where does coverage overlap?

The differences

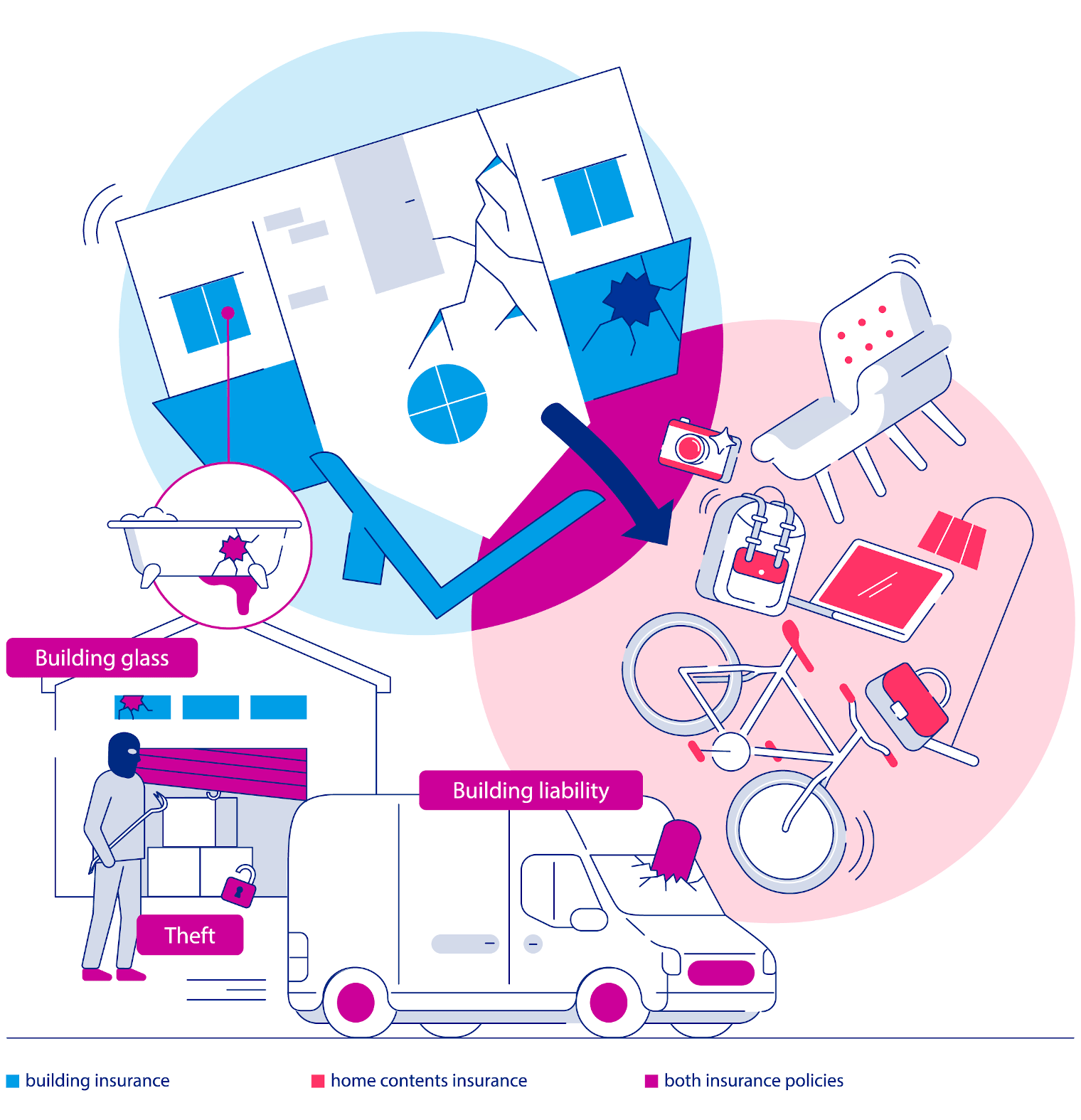

Put simply, home contents insurance covers all your household and personal belongings, i.e., everything that you could take with you if you moved. By contrast, building insurance covers damage to your house, i.e., to the actual building, including fixtures such as gutters or a fitted kitchen.

The similarities

The two types of insurance have a lot in common when it comes to the property damage and hazards covered: damage caused by fire and natural disasters, earthquakes or theft, as well as water damage and glass breakage. Then there is also comprehensive coverage, which insures against material damage caused by something other than the risks mentioned above, e.g., graffiti on house walls (building insurance (“extended coverage”) or if you lose your tablet (“comprehensive household insurance”). Here, too, the rule of thumb is that building insurance pays for damage to the building, whereas home contents insurance pays for damage to home contents.

Where coverage overlaps

An exception to every rule: Certain risks can be covered by both types of insurance. It is best to get personal advice from UBS so that we can adjust your insurance in the event of any overlap.

Building liability insurance

With most insurance policies, building liability insurance can be incorporated into a private liability insurance policy. At Baloise, the condition for obtaining this form of coverage is that your real estate is used only for private purposes and is comprised of a maximum of three apartments, one of which you live in yourself. If this is the case, building liability is automatically insured by your private liability insurance and you do not need to arrange separate coverage via a building insurance policy.

Property insurance: theft

In the event of burglary or attempted burglary, damage to the building is covered both by your building insurance and home contents insurance. In the latter case, however, it depends on the amounts insured: if your policy is very limited, you may not be sufficiently covered. That is why we generally recommend you take out a building insurance policy. We advise you to discuss the best solution with your insurance advisor.

Property insurance: glass breakage

The glass in a building can also be insured as part of a home contents policy, but does not have to be. If it is included, then you would also be insured against damage to glazing, including sanitary facilities (sinks, bathtubs) and ceramic stove tops. As these items come under the category of “permanent building fixture,” they are also covered in the building insurance under “building glass.”

Examples of property damage: which insurance pays?

A fire has destroyed the top story of our building including the roof and interior furnishings.

The building itself, including the roof, is covered by the building insurance; the interior furnishings by the home contents insurance.

A flood has damaged parts of our garage and an entire stamp collection that was stored there.

The garage building is covered by building insurance and the stamp collection is covered by the home contents insurance.

Our home was broken into – the front door and a window were damaged. In addition, some valuables and cash are missing.

Damage to the front door and the window is covered by the building insurance. This is on condition that “Theft” coverage is included in the insurance cover. If not, it will be covered by home contents insurance. The valuables and the cash are covered by home contents insurance, as part of “cash valuables” in the home contents insurance.

I dropped a heavy object into the sink and it’s now broken.

The sink is either insured under “Building glass” as part of the residential building insurance, or via the home contents insurance. If you have taken out both insurance policies, clarify with your insurance advisor whether there is any overlap and if your contracts need to be adjusted accordingly.

Examples of third-party damage: which insurance pays?

A tile from our roof damaged our neighbor’s car.

In this situation, building liability insurance applies and you should contact your insurance company immediately. The damage may also be covered by a fully comprehensive insurance policy for the vehicle. In cases of doubt, the insurance companies will agree between themselves on who pays. This is not something you need to clarify yourself.

A tree in our garden fell down and has damaged our neighbor’s house.

This event is clearly covered by building liability insurance.

The same situations as above, but someone got hurt.

Building liability insurance also covers this eventuality. As mentioned above, building liability insurance can also be integrated into private liability insurance in the case of single-family homes you live in yourself or vacation homes.

Your own home – well protected

We will be happy to accompany you step by step on your path to your dream home. Together with our partner Baloise Insurance, we will ensure that you find the right insurance policy for your property.