Life insurance when buying a home: yes or no?

Life insurance can be used in two different phases of buying a home. Before the actual purchase, it can be used to save equity. After purchase, it is a way of ensuring that your home remains affordable if you cannot work or suffer some other misfortune. In our article, we discuss the different scenarios and use specific examples to illustrate the key considerations and calculations.

Life insurance to save equity

When you buy a home, you need to finance at least 20% of the purchase price with your own savings. A maximum of 10% can come from pillar 2; the rest must be from your own savings, from pillar 3a or from an inheritance. If you start planning to own your own home from a young age, you can save for the deposit with a savings bank life insurance policy. In addition to the savings aspect, a life insurance policy also offers tax benefits because insurance premiums deposited in pillar 3a can be deducted from your taxable income. First, you should analyze your retirement situation in detail in order to close pension gaps and identify the right product for your retirement and savings goals. Shortly before buying a home, you can withdraw the capital or pledge it as part of the financing.

By the way, if you want to quickly and easily check the current market value of the home you want to buy, you can do so with the property assessment tool.

Life insurance as protection from risk

When buying a house, another kind of insurance comes into play known as “term insurance” or “risk life insurance.” This is an insurance against disability and/or death and ensures that in the event of a misfortune, the surviving dependents can continue to pay the mortgage and keep their home. Especially for families with only one main breadwinner, an affordability calculation should be carried out and a realistically high insurance figure set.

Insurance with capital accumulation can also be used for indirect amortization, i.e., for partial repayment of a mortgage. The capital built up in pillar 3a through regular payments is used for amortization only after the pillar 3a account is closed. However, until this point, the amounts deposited qualify for tax relief.

Calculation example: the Fehr family

If all goes well

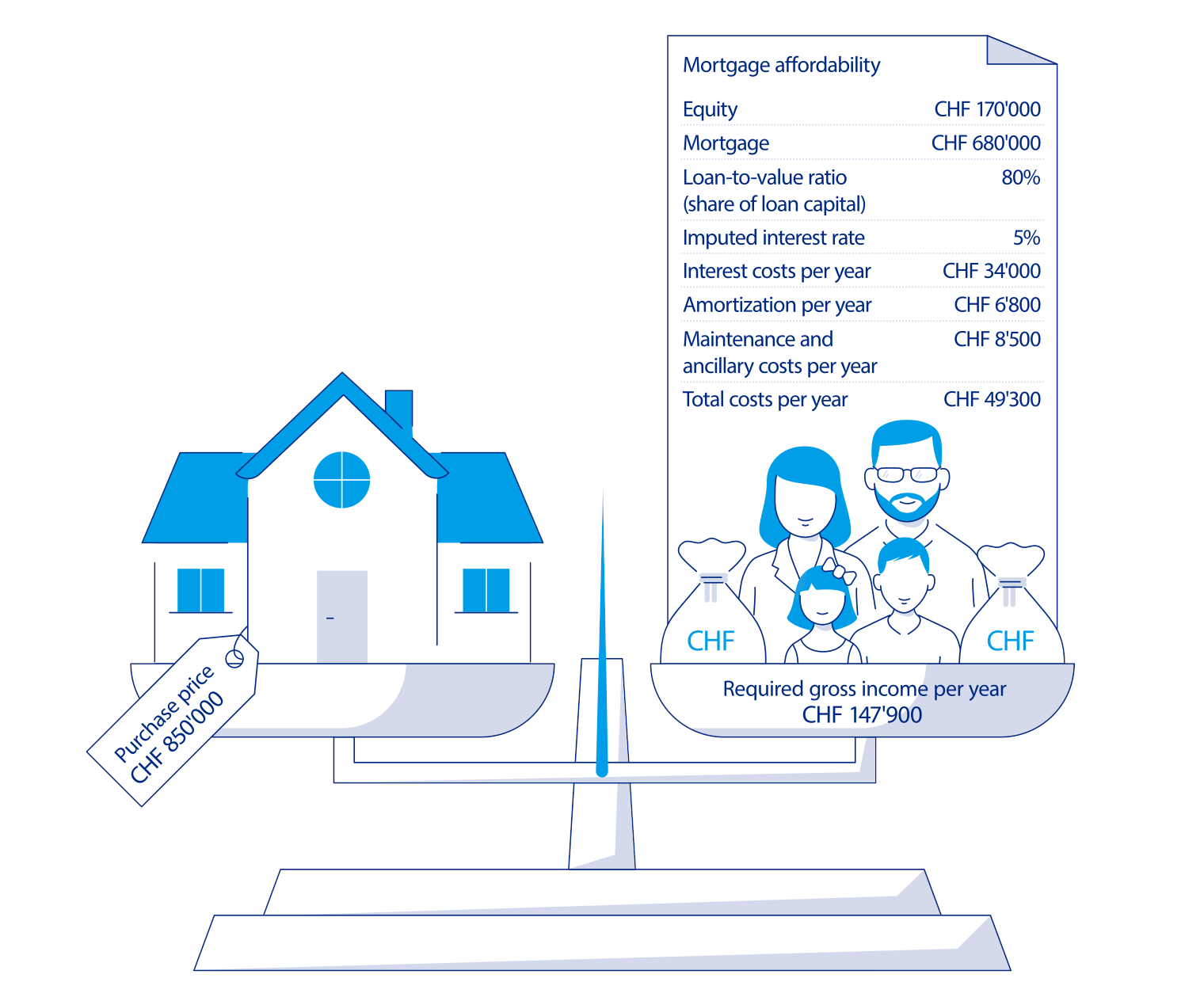

What does this mean in figures? Let’s take the Fehrs as an example. Tim is 40 years old and works full time as a manager at an IT company. His gross salary is CHF 150,000 a year. Laura is also 40 and works part time (40%) as a teacher. She earns CHF 30,000 a year. They have two children aged eight and five. They buy a house for CHF 850,000 for which they take out a mortgage for CHF 680,000. The required equity comes from their joint savings. Let’s take a look at how affordable their mortgage is:

For the mortgage to be affordable, the couple needs to earn CHF 147,900 a year, gross. Laura and Tim have a joint income of CHF180,000 a year, meaning the mortgage is affordable.

What happens if the main breadwinner is unable to work?

What happens to the family’s financial situation if Tim is unable to work due to illness? In this situation the family will receive financial support from pillars 1 and 2: CHF 49,612 from pillar 1 including child allowance, and CHF 50,000 from pillar 2. The annual income from state allowances and Laura’s job is therefore approximately CHF 130,000. To ensure they can still pay the mortgage, the Fehrs need a disability pension due to illness of CHF 18,000. If Tim is unable to work due to an accident, however, no insurance will be necessary because the mandatory state and occupational benefits will be sufficient.

What happens if the main breadwinner dies?

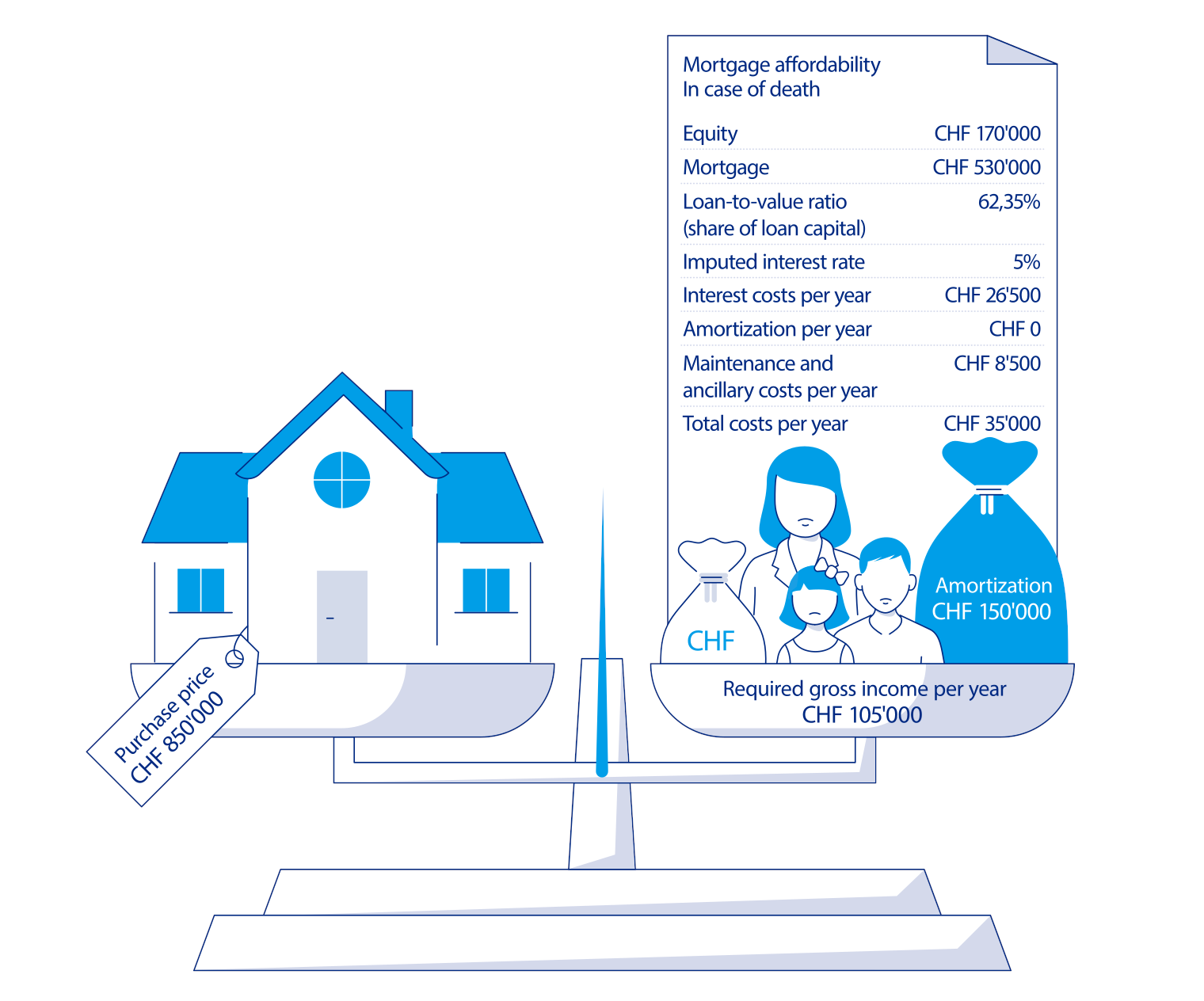

No one likes to talk about death. However, it is important for (future) homeowners to be prepared for the possibility of dying before their time and to plan for the financial consequences should misfortune strike. If Tim were to die, Laura would receive a widow’s pension of CHF 45,888 from pillar 1 and CHF 30,000 from pillar 2. Her annual gross income would then be CHF 106,000. For the mortgage to remain affordable, it would need to be reduced by CHF 150,000.

In this case, the Fehrs should take out insurance for the amortization of CHF 150,000. They should also insure the statutory portion of the inheritance of own funds stipulated for minors, which in this case amounts to around CHF 40,000. As Laura will receive capital payments if her husband dies, additional one-time capital gains taxes will be due, which must also be anticipated. When the children come of age, child allowance will cease and Laura will either have to work more hours or compensate for the lack of child allowance via the life insurance. In the light of all these considerations, the Fehrs should take out term insurance for an insured sum of at least CHF 200,000.

Summary

No one likes to think about death or possible misfortune, but it is a good idea to consider these eventualities and to insure yourself against them. For an individual, tailored solution, different factors are key: job, family situation and mortgage debt, to name just a few. It’s worth looking into this topic as soon as you can and getting advice from an expert.